Before enrollment

Before enrollment

The basics of enrollment in health insurance

Choosing and signing up for health insurance may not be as fun as choosing where to vacation and buying those tickets. It can also be tough to know when and how to enroll. But having health insurance is critical to protect you and your loved ones from huge bills you cannot afford. Here are some basics that can help.

Are you eligible for a special enrollment period?

A qualifying life event is a change in your life that allows you to enroll or change your health insurance plan during a special enrollment period (SEP). The length of your SEP varies. Some examples of qualifying life events:

- Marriage

- Baby

- Job Change

- Moving

- Becoming a US Citizen

- Divorce

- Family Death

Selecting a health insurance plan is like searching for the right pair of jeans. It can be time consuming, and you may have to look at several, but it’s worth it to find the right fit.

Turning 26 means aging off your parents’ health insurance plan.

Most individuals turning 26 are required to enroll in a health insurance plan – whether it be in an individual plan or group plan through an employer. You cannot stay on your parents' plan any longer, but don’t worry—we’ve got options for you. And you may qualify for financial assistance.

Aging off your parents’ plan is considered a qualifying life event (QLE). There are many other types of QLEs, like a change in marital status or a loss of group coverage. When you experience a QLE, you qualify for a Special Enrollment Period (SEP) which allows you to enroll in a new health insurance plan outside of the Open Enrollment Period (OEP).

Your SEP begins 60 days before your 26th birthday and ends 60 days afterward. If you do not enroll in a new plan during your SEP, you will have to wait until the next OEP which occurs annually from November 1 to January 15.

How your medical expenses get paid

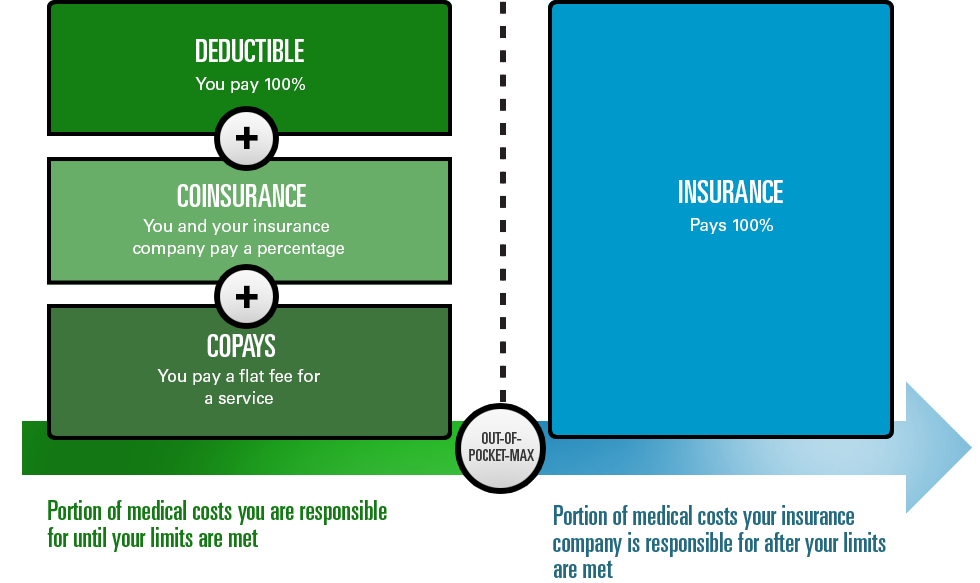

You and your insurance company share the cost of your care until you meet your out-of-pocket maximum for the year. Your deductible, coinsurance and copays add up to the out-of-pocket maximum. Regardless of the amount of care you receive, your monthly premium will need to be paid.

Financial assistance

If you struggle with the cost of health insurance, it's important to know that you might qualify for financial assistance, known as subsidies, based on your income.

The types of assistance available include:

- A tax credit, sometimes referred to as an advanced premium tax credit (APTC), that helps you pay for all or part of your monthly bill (or premium). Use our online tool to see if you qualify.

- A discount (called a cost-sharing reduction) that helps pay your share of costs for your medical care, such as deductibles, coinsurance and copays. If you're a member of a federally recognized tribe, you may qualify for additional cost-sharing benefits. See if you qualify for savings .

How do they determine financial help?

The federal poverty level (FPL) determines if you qualify for certain programs and benefits, including tax credits for purchasing health insurance. The Department of Health and Human Services (HHS) determines which incomes are considered above or below the poverty level. To find out more, view the qualifying income chart or for the most current information, visit the HHS poverty guidelines .